- #FREE MICROSOFT EXCEL TEMPLATES FOR MONTHLY EXPENSES HOW TO#

- #FREE MICROSOFT EXCEL TEMPLATES FOR MONTHLY EXPENSES PDF#

- #FREE MICROSOFT EXCEL TEMPLATES FOR MONTHLY EXPENSES DOWNLOAD#

This template has the following features:

#FREE MICROSOFT EXCEL TEMPLATES FOR MONTHLY EXPENSES DOWNLOAD#

You can also download this free Excel 2013 template and use it in previous versions of Excel, like MS Excel 2010.

#FREE MICROSOFT EXCEL TEMPLATES FOR MONTHLY EXPENSES HOW TO#

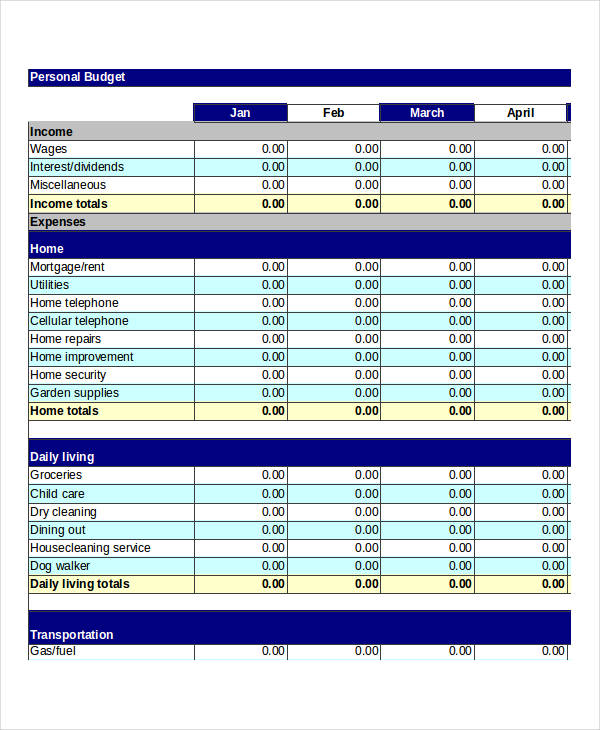

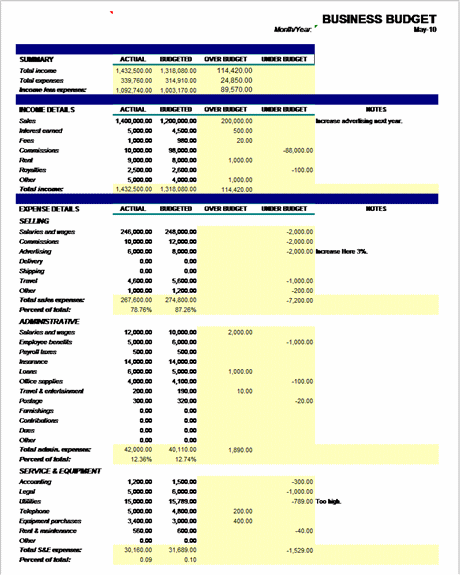

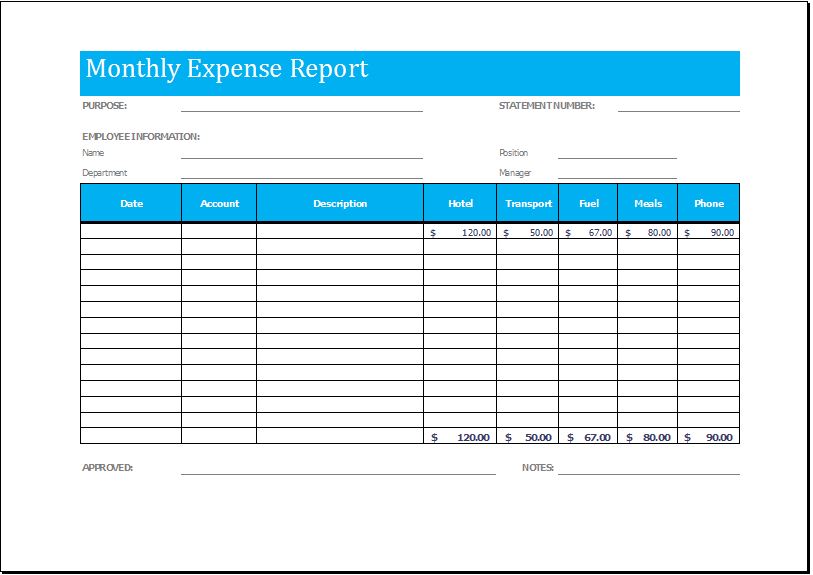

The Monthly expenses table data lets you enter amount for different items, for example rent and mortgage or electric expenses (you can learn more about how to get free electricity), gas expenses, cell phone expenses, car payment, auto insurance, personal care, as well as expenses for credit cards, entertainment or student loans). This chart was created using a bar chart style buy you can easily change it if needed. Then you can see a nice bar chart with your income vs. As you can see, it is using the AutoExpandable table feature in Excel 2013 so you can add more rows to the expenses table if needed. You can learn more about how to use Excel by viewing our FREE Excel webinar training on Formulas, Pivot Tables, Power Query, and Macros & VBA!Ĭlick here to get various other time-saving Excel spreadsheet templates (provided by Microsoft) for budgets, inventory, schedules, Gantt charts, timelines, and more.The budget template for Excel 2013 has a table to enter the income data and then you can enter the expenses line by line.

#FREE MICROSOFT EXCEL TEMPLATES FOR MONTHLY EXPENSES PDF#

Make sure to download our FREE PDF on the 333 Excel keyboard Shortcuts here: Using this Excel template, you can easily manage your finances and make your financial health a priority.Ĭheck out all our other Free 141 Excel templates here. That’s it! Your monthly budget spreadsheet is prepared.īut, you need to remember that this is a continuous process and you need to make necessary additions and revisions as and when required.Įxcel is the go-to tool for planning and tracking your personal and business finances. In the end, all you need to do is repeat the same process each month and take into consideration any new savings goals or expenditures you may encounter in the future. NET INCOME, after taking into account your savings goal and monthly expenditure. It will provide you with the amount you are left with i.e. Once all these values have been entered, your summary table will be ready too! The best practice would be to put in place money for these expenses so that you are prepared for it.Įnter amounts for each of these expenses.Įxcel will automatically calculate the percentage allocation for the expenses categories and the TOTAL monthly expenses as well. In the Expenses section, there are different categories mentioned like home, food, health, transportation, debt, entertainment, personal care, etc. The next step would be to list down where you spend your money each month. The amount in dollar terms for each Saving & Investment and the TOTAL savings amount will be automatically calculated in Excel. Enter the percentage of your income you want to save. You need to determine the amount you wish to put aside for different milestones in the future. Next, you should plan your savings for different purposes based on your income and expenses. The total income will automatically be calculated and displayed in cell F7 – $6350. If you have your own business but the income is not constant, you can take an average of your past 6 months and enter that amount.įor example, you can enter a salary income in cell F4 – $5,000, extra income from part-time jobs in cell F5 – $850, and income from investments in cell F6- $500. Let’s look into each of these steps one-by-one!ĭownload this Excel workbook and follow this tutorial on how to make a budget spreadsheet in Excel:īegin using this template by entering the different sources of your monthly income.įor a person with a salary, simply enter your monthly salary (post-tax) and income from other part-time jobs or passive income streams. The steps followed in this FREE Excel template are: You can easily manage your money with this free Excel template and you will never exhaust your funds and enter into a debt hole.

You need to plan your savings and spending goals so that you never run out of money at the end of the month and keep your wife or boss happy.

This Free Budget Spreadsheet can be used to keep your finances intact. Just put in values in a few cells and Excel will calculate the rest for you! A simple solution to this is to use an Excel budget spreadsheet!Ī Budget spreadsheet template can make the process of financial allocation simpler and help you gain visibility into your finances. But following this, in reality, can be quite a task. The basic principle of any budget is to keep your expenses lower than your income and you will be never running out of money.

0 kommentar(er)

0 kommentar(er)